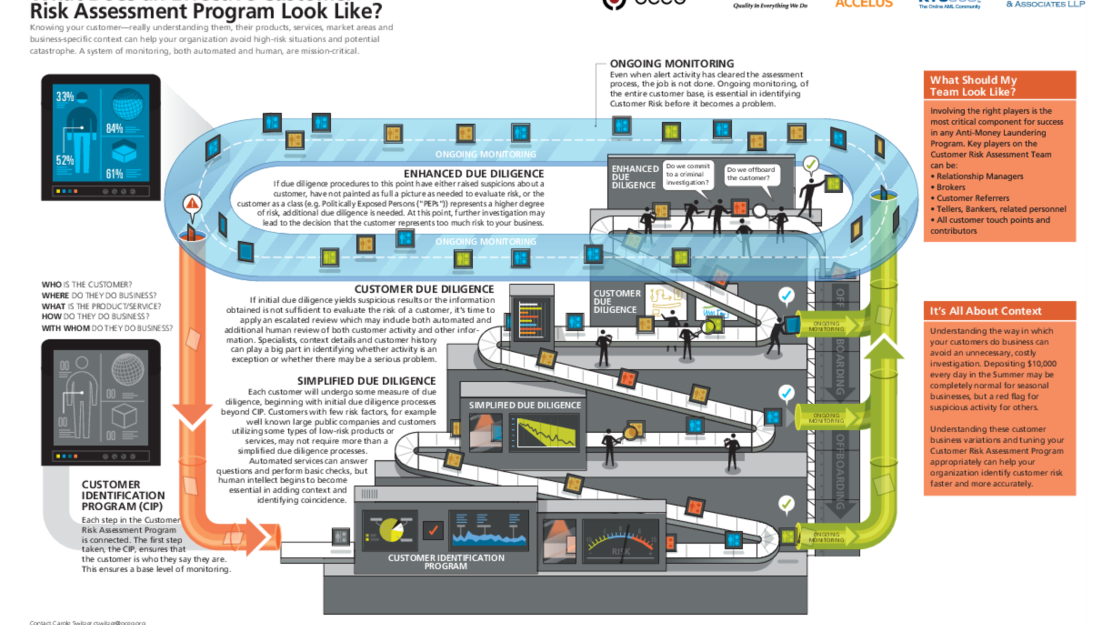

Illustration – AML Series #3 – What Does An Effective Customer Risk Assessment Program Look Like

You are currently focusing on the certification. Go to program dashboard.

This third installment in OCEG™ ‘s Anti-Money Laundering Illustrated Series addresses how to assess customers to identify those that may engage in money laundering.

This third installment in OCEG™ ‘s Anti-Money Laundering Illustrated Series addresses how to assess customers to identify those that may engage in money laundering.

Knowing your customer—really understanding them, their products, services, market areas, and business-specific context, can help your organization avoid high-risk situations and potential catastrophe. A system of monitoring, that checks both automated and human processes, decisions and actions, helps you identify risk before it becomes a problem.

Featured in: Compliance , Anti-Money Laundering , Risk Management , Anti-Money Laundering (AML) Series

Like many websites, we use cookies and similar technologies such as session storage and analytics scripts to keep the site running smoothly and understand how visitors interact with our content. These tools may automatically collect technical information, including your device type, IP address, and browsing behavior.

By continuing to use this site, you acknowledge and accept this usage. For more information, please review our Terms of Service and Privacy Policy.

2942 N 24th St Ste 115 PMB 85352, Phoenix, AZ, 85016-7849, USA

Information & Billing

+1 (602) 234-9278

Principled Performance®, Driving Principled Performance®, Putting Principles Into Practice®, OCEG®, GRC360°®, ActiveLearning®, EventDay® and LeanGRC® are registered trademarks of OCEG®.

Protector Skillset™, Protector Mindset™, Protector Code™, Lines of Accountability™, GRC Professional™, GRCP™, GRC Fundamentals™, GRC Auditor™, GRCA™, GRC Audit Fundamentals™, Data Privacy Fundamentals™, Integrated Data Privacy Professional™, IDPP™, Policy Management Fundamentals™, Integrated Policy Management Professional™, IPMP™, Integrated Audit & Assurance Professional™, IAAP™, Integrated Governance & Oversight Professional™, IGOP™, Integrated Strategy & Performance Professional™, ISPP™, Integrated Risk Management Professional™, IRMP™, Integrated Decision Management Professional™, IDMP™, Integrated Compliance & Ethics Professional™, ICEP™, Integrated Business Continuity Professional™, IBCP™, Integrated Information Security Professional™, IISP™ are trademarks of OCEG®.